Gary Shawhan, Contributing Editor & Shiva Rapolu, Director of Analytics

The CHEMARK Consulting Group

Brand identity and brand strength are important components in establishing and sustaining the value of a company’s products or services. This applies to companies that participate at all levels of the supply chain including raw material manufacturers, additive suppliers, formulators and manufactures of finished goods.

Within the coatings market, individual companies (at various positions in the supply chain) differ in the market segments they serve, the products, technologies or services they offer and the geographies they cover. Regardless of a company’s business profile, creating strong and sustainable value propositions for the company’s products/or services is a critical element in achieving and sustaining revenue growth and long-term profitability.

Effective branding is an important element in a company’s business strategy as it supports a strong value proposition which is sustainable over time. Brand identity and strength elevate a company’s competitive position in the marketplace.

Support for brand strength does require an investment commitment by management to garner this value and lengthen its life. Creating and then protecting value in products and/or services, however, is a shared responsibility within any organization (whether large or small). Its success is driven by the overall company culture and dependent on a commitment from individual employees through all levels of the organization.

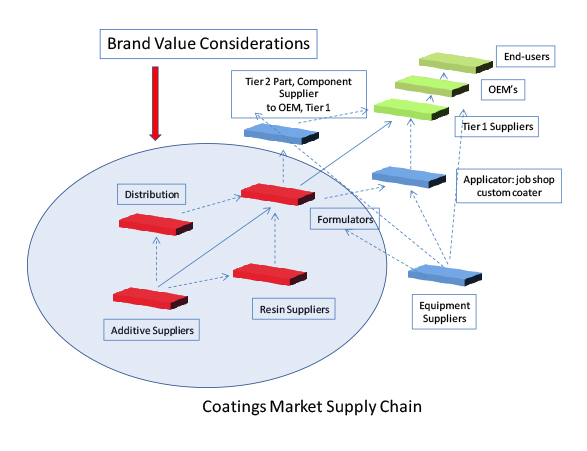

Branding, as a means of creating and sustaining value, can be used as a tactic addressing specific market segments. Branding can also be directed at specific product lines or incorporated into the company’s overall business philosophy. Within the coatings market, branding is a very important strategy for both additive suppliers and formulators (Figure 1).

Figure 1: Coating Market Supply Chain

Brand identity provides formulators differentiation among their competitors. It can offer value protection at specific customers or within certain markets where product approvals are required or supplier QPL’s are involved. Formulated coatings, which have identifiable performance features and benefits that stand-out from competitors, clearly have the potential to deliver sustainable value when supported by a strong branding strategy. Certain markets, however, only require a minimum level of final coating performance or are ones that have matured into a commodity market situation. These markets are also easily accessed by many suppliers with similar products. As a consequence, there is typically very limited space forward in the value chain that will support a value-added proposition or brand strength as a differentiator.

Stepping down in the supply chain, additives suppliers face different challenges in value creation and reinforcement. Trade names and branding strategies become a critical part of the go-to-market strategies for these suppliers. Additives (contained in coating formulations) identified by brand name and product nomenclature normally retain their value longer. Brand identity often complicates both market entry efforts and the subsequent approval process for alternative products from perspective suppliers. Brand strengthening and reinforcement through incremental improvements (for a given additive) that do not necessarily require a full requalification can lengthen and protect market value.

The value of branding is maximized when extensive laboratory testing along with field testing of the finished formulations are required. The time and resources needed to approve an alternative source of supply become difficult to justify. End-use applications, which have stringent long-term coating performance requirements, often tied to warrantees, add to the reluctance of formulators to submit modified formulations to their customers for existing specification business. Equipment manufacturers need a compelling reason to consider approving an alternative source of supply since such changes can carry liabilities when field failures occur.

Distribution, as a channel-to-market, plays a very important role for additive manufacturers supplying to coating formulators. Brand strength coupled with breath in the end-use market- reach associated with a given additive product line or product portfolio is extremely important and carries with it a high value in distribution. A strong brand represents leverage for additive suppliers when competing for a position with the best distributors as one of their principles. Distributors, in fact, compete with each other in order to represent the strongest brands in each additive category.

Mergers and acquisitions, within the paint and coatings market, have erased or diminished a number of recognizable brands that carried with them significant commercial value. These brand values were frequently ones built-up over many years and represented a level of quality and performance which differentiated them from other competitors. This brand identity also stretched across multiple levels of the supply chain. Company’s contemplating or involved in M&A activities today have too often lost sight of these values in the rush to incorporate these added products or services into their own business. Customers have been lost and the expected market gains have sometimes been compromised as competitors capitalize on the situation. Company’s active or contemplating M&A activities should consider the values the exist in the brands they are acquiring and find ways to retain this value as part of this process.