Gary Shawhan, Contributing Editor

The CHEMARK Consulting Group

When entering a market with a new product or service the company’s goal is to achieve revenue growth and increase profits.

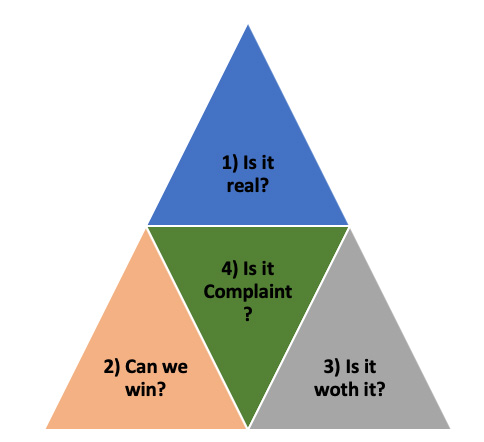

As a continuation of the “decision making considerations” covered in Part 1 (last month), Part 2 expands on each of the key points highlighted in Figure 1 below.

Is it Real?

Is the Market Real?

What is the market structure and the “real opportunity” that exists for the company?

Identifying the overall size of the target market is helpful as a guide. Understanding what the actual size of the opportunity is for the company with the new product is key. In this regard, knowing the structure of the market provides important clues as to its viability.

What are the market requirements, specifications and unmet needs present in the target market space?

Determine the path-to-market that will leads to customer acceptance/approval of your new product or service. Matching features and benefits to market/customer needs reveals key critical path elements necessary for success. Among these elements is a realistic assessment of the time-to-market and the resourcing required to support the effort.

What is the business situation in the market today and looking forward?

Understand the priority that your new product or service would likely be given by target customers in the market. Attractive features and benefits do not necessarily translate into action by potential customers. Competition for resources and over-riding business priorities at target accounts needs to be taking into consideration when evaluating the probabilities for commercial success.

Is the Product Real?

How is the new product concept aligned with market needs?

New product ideas have many origins and sources of inspiration. The product should satisfy identifiable market needs. Unique, state-of-the-art products attract attention and interest. This, unfortunately, does not necessarily translate into sales. Vetting the product through valid, industry recognized testing that demonstrates the ability of the product to deliver a solution to a current need is key.

Can the product be manufactured?

Having a plan to scale-up manufacturing that will meet the market demand is high on the list of items that need to be addressed before going forward with customer introductions. Without certainty that the product can be supplied in commercial quantities, potential customers will be reluctant, if not unwilling, to commit the resources needed to evaluate, test and approve a new product.

Will it satisfy the market?

Determine the cost to manufacture the product in commercial quantities early. Make sure that the price point required in the target market provides adequate margins to support a commercialization effort. This is fundamental to a go or no-go decision to move forward. Product design and it’s suitability for integration with current manufacturing methods is another consideration. Is there a need for capital to support scale up before there is revenue from sales to support these costs?

Can we Win?

Can the Product be Competitive?

Will the pricing or value-capture strategy work?

Setting the right price point at the start of discussions with potential customers is critical. You can almost never increase the price down the road. Understand your realistic cost-to-manufacture and the added cost for the internal support resources that will be required to bring the product forward-to-the-market.

Consider customer expectations for terms and/or contractual conditions. Alternative value-capture strategies such as licensing or exclusivity need to be carefully assessed as a strategy- especially if viable, competitive products are sold without such constraints.

Do we understand the actual time required to be successful?

Time-to-market estimates for a new product should be realistic. Just as important, this timeframe needs to be assignable to a benchmarked goal. This goal could be time to first sale; time to break-even: time to achieve payback on the research and development investment; or time to achieve a specific cash flow level. For new product launches the time-to-market estimate is often underestimated.

Are the feature and benefits of the product competitive?

Benchmark the competition, especially the market leaders and the market challengers. Determine what is considered the industry standard and then identify what is being offered by the market challengers trying to displace share from the leader.

Can Our Company be Competitive?

Are the companies engineering, technical service, R&D capabilities and manufacturing operations in-line with market/customer expectations?

Assess the company’s existing internal support resources. Is there a need to add experience and resources to adequately measure up to competitors? Evaluate the capacity and the logistics of the company’s current manufacturing operations in relation to the intended market and customer concentrations.

How do the current sales force, warehousing and distribution channels stack up to competition?

Each market has its own characteristics as it pertains to introducing and successfully capturing new business with new products. Identifying and having access to the channels-to-market that are sufficient to level the playing field against competitors is a basic need. With distribution, having a position as one of their principle suppliers provides visibility and attention from their sales force not afforded to second tier, suppliers. Geographic coverage from your distribution network should align with the important regions where opportunities exist for your new product.

A direct sales force is an alternative or can be a compliment to distribution. When relying on distribution as the primary channel-to-market, it is especially important to determine how much attention will be paid to the new product as opposed to current sales from higher volume established product lines.

Often an assessment of how a sales force (internal or distribution) is compensated will reveal the attention that may be paid to promoting a new product.

How about the management team?

The strength of the company’s financial position and business outlook is an over-riding element that typically determines the level of support for new products and entry into new markets. When the company’s business situation is less favorable, patience with sales results from new product introductions can wear thin in a much shorter timeframe. Understand the business climate, the company culture and the business outlook early-on to keep expectations more in-line with reality.

Separately, is management experienced in the market and technology area that is being proposed for market? The new product may be unique and have many features and benefits. If management is not sufficiently familiar with the target market or the product/technology, continued support will be an on-going internal selling process and an area of concern.

Is it Worth It?

Will it be profitable?

Can we afford it?

Cash flow requirements, in relation to cash flow expectations, need to be evaluated. Depending on the strength of the company’ current business and the outlook for the near-term, there can be significant gap in the length of time management will extend the purse strings.

Is the return adequate?

Often companies have financial benchmarks that provides a set of criteria which determines the value and merits of individual projects. If these criteria exist, then there is likely a process in place that helps determine the “company fit” for individual projects. If not, key financial metrics can be used to obtain a realistic check on the financial return that can be realized for the new product effort.

Is the risk acceptable?

“What if” circumstances that can alter and change expected financial results for the project should be considered. There may be several go/no-go points during the commercialization process that are intentionally placed into the overall plan. This approach provides some added control by management which reduces risk. It also provides check points that allow for course corrections which may be needed. When problems develop that are an unexpected surprise to management, reactions can be more drastic as the risks to continue the project may be considered to be too high.

Does it satisfy other company needs?

Does it fit with the company’s goals and strategic objectives?

Alignment with the company’s long-term strategies and business plan is important. As project costs increase and the timeframe needed to reach a point of commercial success and positive cash flow is extended, its fit with the company’s strategic objectives can change.

Will it strengthen the company’s image or business position in some way?

Introducing a new product to the market brings with it important benefits to the company. Channels-to-market, including distributors and reps, can offer their customers new solutions or a more complete product line. The company’s image within the marketplace can be enhanced as a leader and solution provider.

Are there special circumstances, external factors (non-regulatory) that could have an overriding impact on the project?

Surprises, during the process of bringing products forward to market, are normally not welcome events. Patent searches and potential infringement problems is one example. Products that involve the use of new, unfamiliar chemicals can cause issues with plant personnel or labor unions. Raw materials that are single-sourced or may vacillate in their costs or availability is another. Try to anticipate the unexpected early-on.

Is it Compliant?

Does the product comply with current, applicable environmental and government regulations?

Regulatory compliance is an over-riding issue for any new product. Registration for new chemicals is a time consuming and costly process. Make sure you know where you stand at the outset with regard to the chemistries involved.

What are the “real costs” to achieve full regulatory compliance?

The costs involved in obtaining regulatory compliance vary widely. For novel, previously un-registered chemistries, these costs need to be carefully examined and considered before going forward. A testing regime that involves outside laboratories and requires a protracted timeframe to complete can prove to be unacceptable to the organization.

As the geographic market scope for the product expands, the costs and the complexity of addressing regulatory compliance also grows. Having a well throughout, go-to-market strategy at the start provides a basis to evaluating the regulatory compliance needs which are required to get the product successfully to market.

Are their pending or proposed regulatory actions in play which can change the game plan for the product?

Significant risk exists when there are proposed or pending regulations that will potentially impact the product being developed and prepared for market. The complexity of global regulatory activity today is significant and a constantly evolving target. A critical element to project definition and planning is to carefully assess the risks that may present themselves in the geographies targeted.