Gary Shawhan, Contributing Editor

The CHEMARK Consulting Group

Charting strategic direction for any coatings business is a necessary component of a successful revenue growth plan. The complexity of this challenge, for any coatings company large or small, continues to increase and for a variety of reasons.

The competitive landscape continues to shift through acquisition and consolidation across all levels of the supply chain. “Who’s on 1st, What’s on 2nd and I don’t know is on 3rd” is a reasonable analogy to the situation most coatings companies involved in the supply of additives, formulation & manufacture, application or specification face today.

The expanded involvement of global companies in serving new, regional or off-shore markets is another important market dynamic that is creating challenges for management to identify the better path’s forward for their business.

In the coating market space, the large, multi-national companies serving this market have significantly greater resources that the medium to smaller size companies with which they can gather key information important to growing their business. Saying that, segregations of various types exist with these large corporations that complicate the strategic planning process. Parochial positions on strategy that vary along geographic or along regional lines or have evolved from historic preferences among acquired company’s produce barriers to change. Strategic planning is complicated by the global complexities of a very large corporation and the divergent inputs that comes from key personal in the organization.

For medium to smaller sized companies, serving the coatings market, the challenge is much greater from a resourcing stand point. It is also often limited in the availability market inputs from internal sources that can help guide choices in strategic direction. time, Implementation of strategies is typically easier that with larger corporations due to the limited amount organizational complications.

Regardless of the size of the organization, however, an increasingly valuable element to strategy development is access to macro-market data. Understanding the impact and/or potential impacts of a wide range of industry trends on a company’s present coatings business and its possible impacts of the future of the business becomes an important management tool.

Analytics and the use of “Big Data” from external sources is a tool that has definite application within the coatings market. Analytics today is frequently employed by large retail corporations, financial institution and pharmaceutical companies to understand the markets they now serve, customer preferences, regional trends, facility location needs and competitive services. It is also employed to examined internally generated company sales patterns (on a regional or global scale) over a 5 to10 year period in relation to a variety of targeted macro-issues such as those noted above. The output from the Analytics process is used by these companies to help determine important strategic direction and course adjustments going forward.

The use of Analytics, within the coatings market, is much less pervasive and mainly limited to the very large global coating manufacturers or those companies serving the market including those companies participating within adjacent levels of the supply chain. Smaller to medium-sized coatings companies (or suppliers) are currently not able to access an Analytics program that is on a scale that makes sense for their business or is tailored to the narrowed focus required to meet their needs.

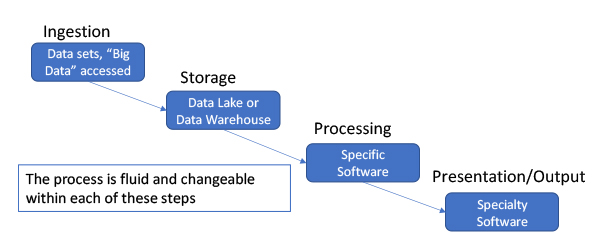

Analytics programs, tailored to the coating market, can be a very important tool to guide company direction and to support of challenge strategic thinking regardless of the company size. As a process, Analytics involves 4 basic sequential steps as shown in Figure 1.

Figure 1: Basic Process Flow for the Analytics Process

Selection of external inputs (data sets) narrowed and customized to the specific business profile and needs of an individual organization is a key element in generating meaningful information as outputs for the process. This is especially true in more specialized markets like coatings. Identify the external “Big Data” sources that are important to the strategic objectives of the company is critical to maximizing the value of Analytics as a tool.

Just as important is identifying availability internal data sources and bringing these data sets into the Analytics process. Overlaying internal data such as sales volumes with external industry data will provide company management with relevant information that can sharpen strategic decision making going forward.

Part 2 of this article will cover details of the Analytics process and discuss examples of its applicability in the coatings market space.