Patrick Jones

Vice President, Strategic Alternatives

Contributing Editor

This month the Business Corner returns to the topic of mergers and acquisitions with the second installment in our three-part series. The initial column in this series took a look at the driving forces shaping today’s middle market M&A environment and introduced three buyer classes: Strategic Buyers, Private Equity and the Family Office. In this column we will look at some of the conventional wisdom associated with so-called Strategic Buyers versus Private Equity and, with the some basic financial modeling, compare and contrast why these two buyer classes take different approaches to deal making.

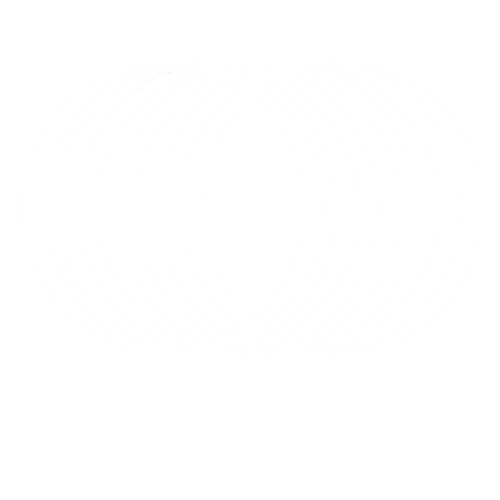

FantasyChem – A Fictitious Specialty Chemicals Manufacturer

To set the stage let us create a fictitious chemical company that would be considered an attractive acquisition opportunity in today’s market. For the purpose of this illustration, we are going to focus on a few basic financial parameters and their impact on value creation. We will assume that the qualitative aspects of the company are what we would expect of a high quality enterprise – no environmental issues, differentiated and defensible product technology, competitive cost structure with high quality manufacturing, and effective leadership and management.

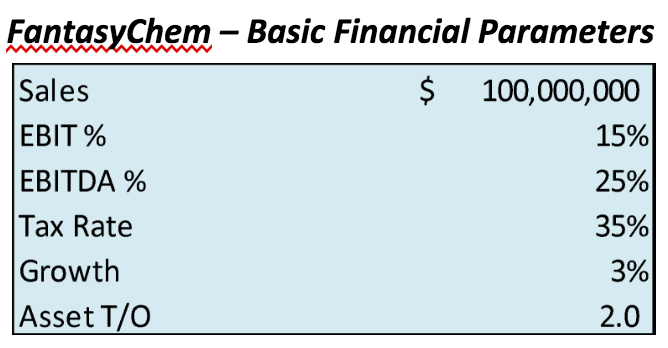

Generally when we think of a strategic buyer, we are thinking of a publicly traded company. As such we would expect a conventional approach to capital budgeting in which the capital structure and balance sheet are managed independently from investment decisions. Theory holds that the firm should invest in projects that meet or exceed its weight-average cost of capital (WACC) and reject investments that fail to meet this hurdle. Therefore, firms often use discounted cash flow (DCF) analysis and internal rate of return (IRR), the rate at which the sum of the discounted project cash flows equal the net investment, to select and prioritize investments of their available capital.

An example of a prototypical DCF analysis of FantasyChem is presented in the green box above. Our strategic buyer ignores any specific financing considerations, such as interest costs, in its review of FantasyChem and instead focuses its attention on determining the upper limit of its valuation range by calculating the purchase price at which the IRR is equal to the WACC. In its analysis, our strategic buyer begins with FantasyChem’s basic financial performance and historic growth rate, assumes a modest synergy (raw materials savings perhaps) of 3% under new management, and calculates that it can pay up to $158 million, 6.3x EBITDA, while earning a return greater than or equal to its WACC.

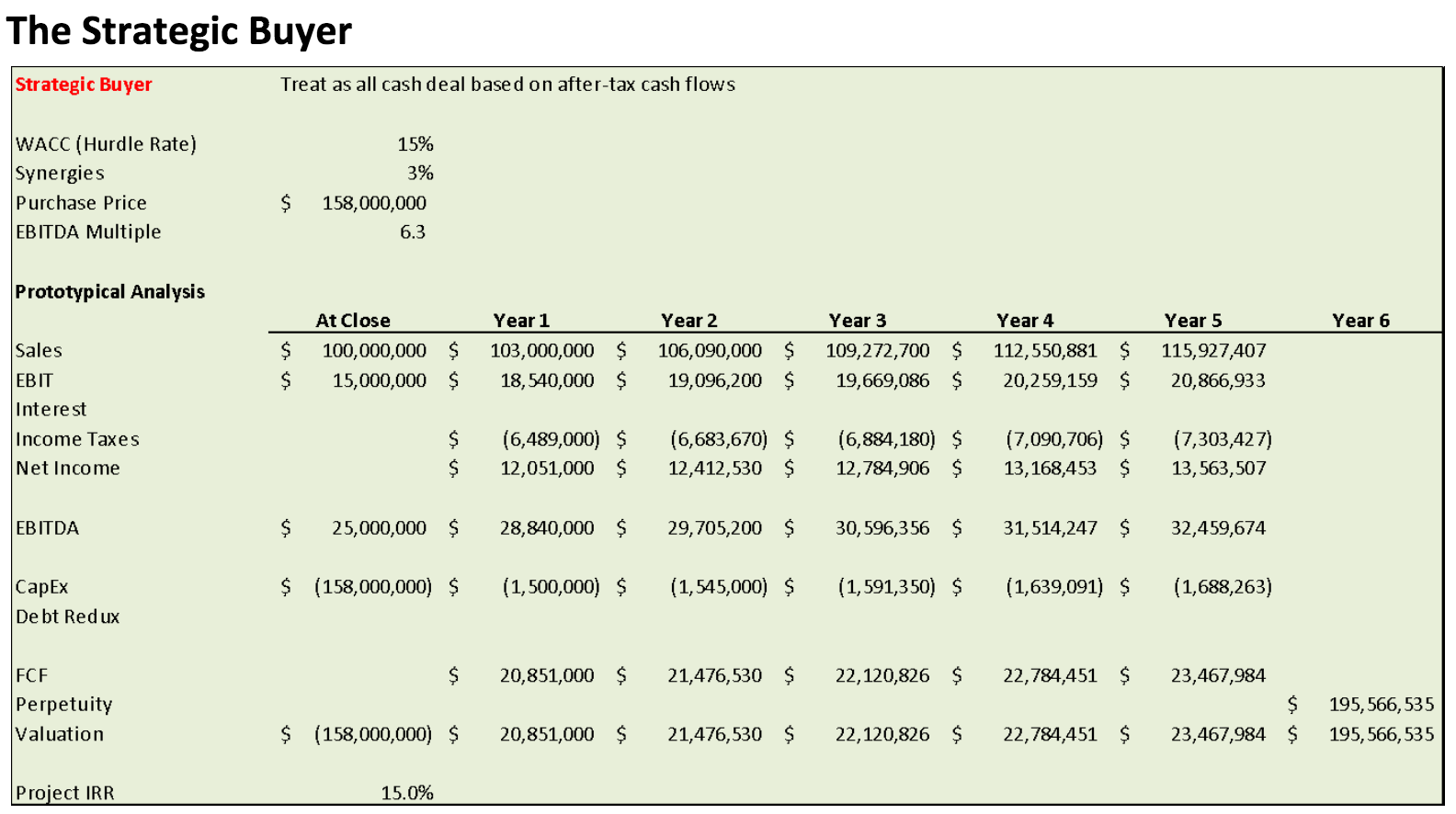

The operative word in Private Equity is “private.” The firms which comprise a PE fund’s portfolio are not publicly traded, and therefore standard capital budgeting theory is replaced with project finance. Simply put, each entity is a singular investment that is financed independently from other entities. Therefore the balance sheet structure cannot be ignored by the private equity buyer when valuing the asset. It becomes paramount that financing considerations such as cost of debt, leverage ratio, interest costs, etc. are factored into the valuation process.

An example of a prototypical project finance scenario for FantasyChem is presented in the rose colored box above. Our private equity buyer must not only look at the cash flow performance of FantasyChem, but it must also apply its project-specific parameters and look at the balance sheet simultaneously with the discounted cash flow analysis. In its project finance analysis, our PE buyer also begins with FantasyChem’s basic financial performance and historic growth rate, factors in specific targets for return on equity (ROE), cost of debt, and beginning and ending leverage ratios, and calculates that it can pay up to $161 million, 6.4x EBITDA, while meeting or exceeding its ROE minimum.

Conventional Wisdom

Comparing the results of the two different treatments of the valuation of FantasyChem, we see that the base case scenario for both buyers delivers essentially the same result: FantasyChem has an enterprise value of roughly $160 million. But, based on what we hear when we talk with people in the real world, such a similar result is not what most people would likely expect. On the contrary, most owners have very strongly held preconceived notions as to which type of buyer they might be willing to engage.

Why is this? And what is the prevailing conventional wisdom?

Let’s start with two of the most common perceptions that we hear, in no particular order. On the one hand some business owners believe that strategic buyers are evil purveyors of cash in search of companies that can be subsumed and wiped from our collective memory. While, on the other hand, some say that private equity firms are bottom feeders that exist only to strip companies to the bone so that they can flip them for a profit. Where any one individual might fall on this continuum is largely a function of his/her personal goals and individual values.

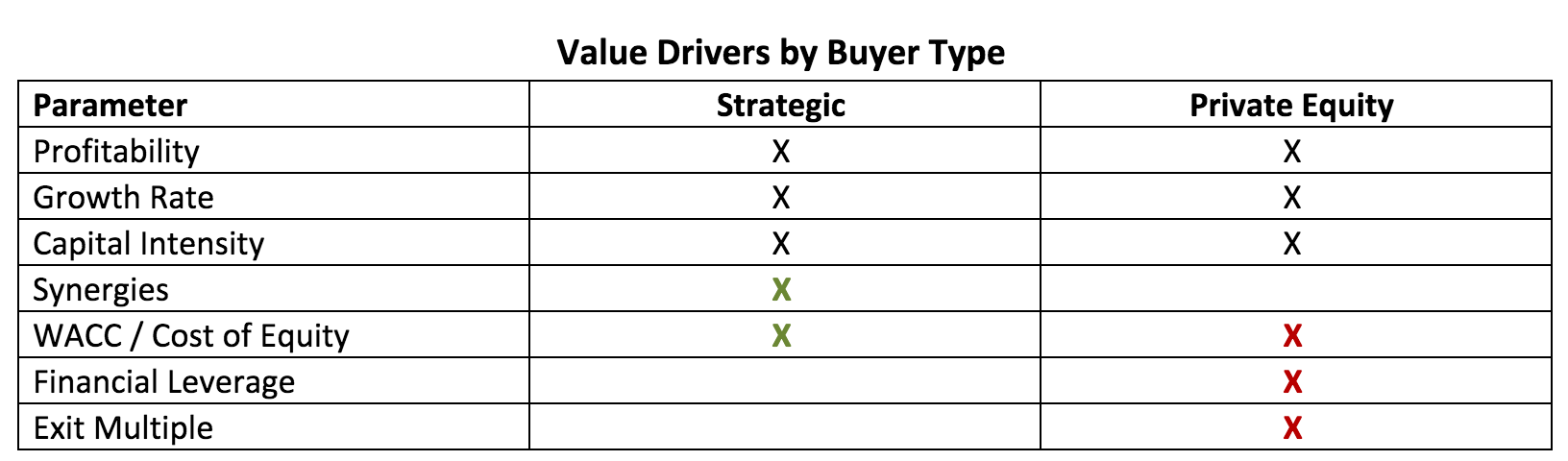

Frankly, we are skeptical of either position, but likely within every cliché is buried a nugget of truth. Rather than inherent evil, bad intentions, or malformed personalities driving buyer behavior, we believe that it is much more reasonable that strategic and private equity buyers must manage different value drivers, process control knobs if you will, at their disposal in order to satisfy their stakeholders. Their behaviors can be interpreted more rationally and sellers can help themselves at the negotiating table with an enhanced understanding of the specific needs of each type of buyer.

Impact of Value Drivers / Sensitivity Analysis

To get a better understanding of how the value drivers influence the behavior of strategic and private equity buyers, we can use the prototypical analyses presented above and look at some sensitivities.

Profitability, growth rate and capital intensity are inputs that impact both classes of buyer in the same manner. Obviously, higher profit margins and higher growth, more than anything else, increase the value of any company because the impact on cash flow is both positive and immediate. The same is true, although the impact is less dramatic, for capital intensity. Since the DCF analysis in either case is based on free cash flow (FCF) which takes into account the capital spending required to support future growth, the less capital investment required the higher the FCF and the greater the value of the enterprise.

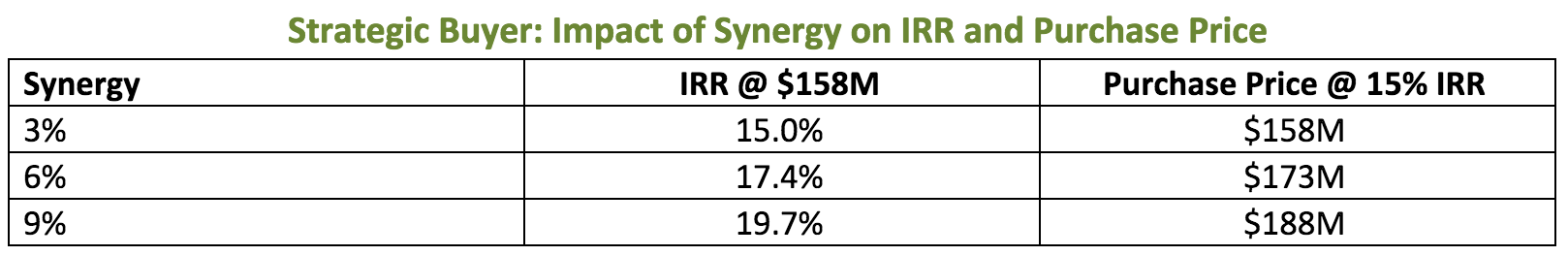

The impact on financial expectations, and consequently on buyer behavior, diverges with the final four parameters highlighted in green and dark red in the table above. Strategic buyers can derive tremendous value if they acquire businesses that are synergistic with their existing footprint. The effect is less meaningful to PE buyers since they are assembling portfolios of independent entities with separate infrastructures. Synergy opportunities include enhanced raw materials purchasing leverage, facilities consolidation, staff / program redundancies, and perhaps capital spending avoidance in existing operations. The following table contains the results of increasing synergy to the Strategic base case.

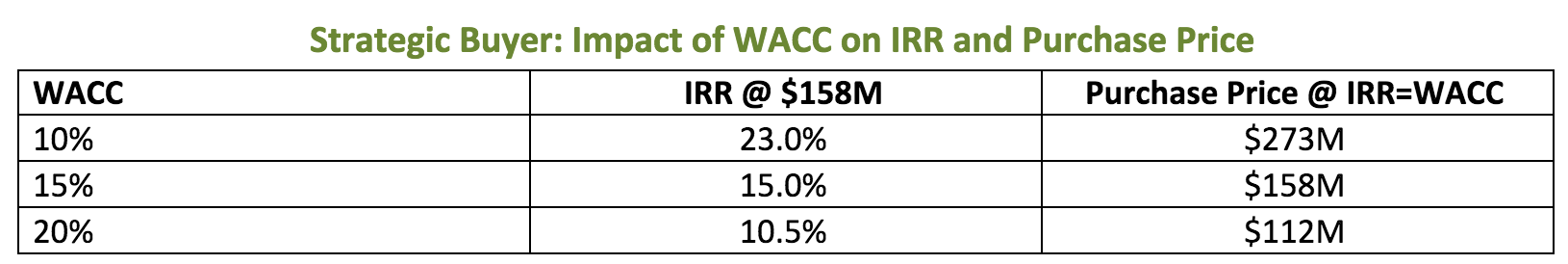

Similarly, the impact of the firm’s WACC is a significant driver in how different strategic buyers see deal value. Calculating the firm’s WACC or internal Hurdle Rate is another topic entirely, but suffice it to say that WACC is inversely proportional to the strength of the firm’s balance sheet and firms with lower hurdle rates or a willingness to relax hurdle rate requirements can gain significant advantage at auction. Mathematically, lowering the WACC effectively inflates the value of the perpetuity component of the valuation calculation intended to represent all future cash flows after year 5. In terms of practical consideration, this makes some sense as the strategic buyer is assumed to have an infinite hold period.

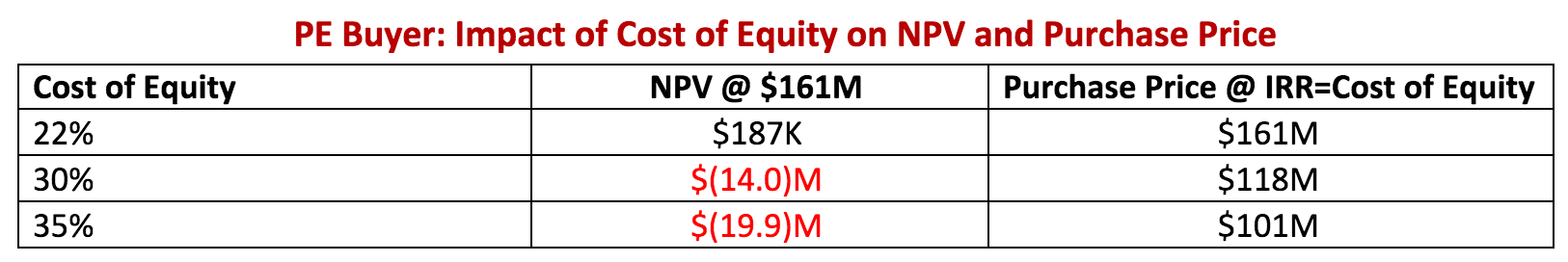

The PE buyer has a different set of financial considerations. One of the most critical to long term survival of the PE firm is meeting or exceeding minimum investor expectations for ROE, typically 20% or more. In our analysis we have assumed ROE has a floor at 22% to cover the 20% minimum ROE plus 2% to cover administrative fees and overhead costs at the PE itself. With project finance, it is often more informative to consider net present value (NPV) of the cash flows instead of IRR as we are looking to determine if we are creating or destroying equity capital. Thus the sensitivity is to ROE expectations in excess of 20%, and the resultant impact on valuation can be seen in the table below:

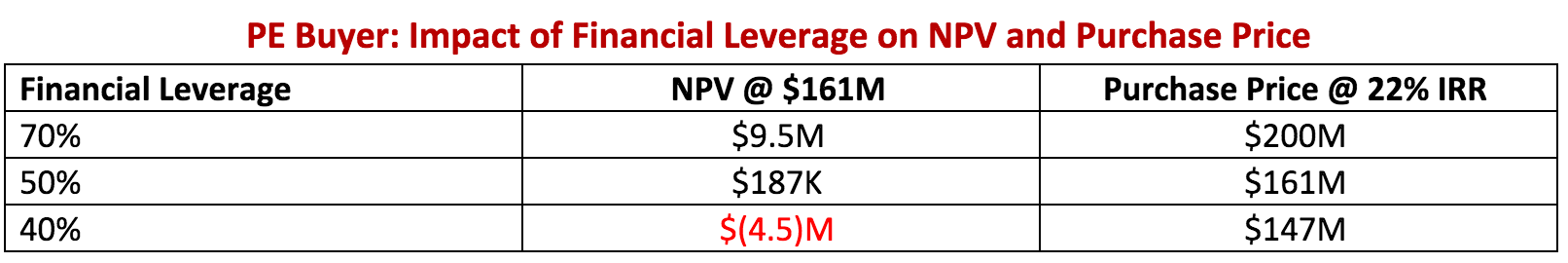

One approach to mitigating the effect of high ROE expectations is to increase the financial leverage used to finance the deal. This works to the potential advantage of equity holders (although at increased risk of loss) by substituting cheaper debt into the capital structure, thus lowering the effective overall cost of capital and potentially improving equity returns. In today’s more conservative lending environment, leverage ratios tend toward 50%, and as noted in the previous article in the series interest rates are at historically low levels. LBO deals of yesteryear with super high leverage ratios are rare, but it is informative to quantify the impact of varying leverage on purchase price and NPV of the investment.

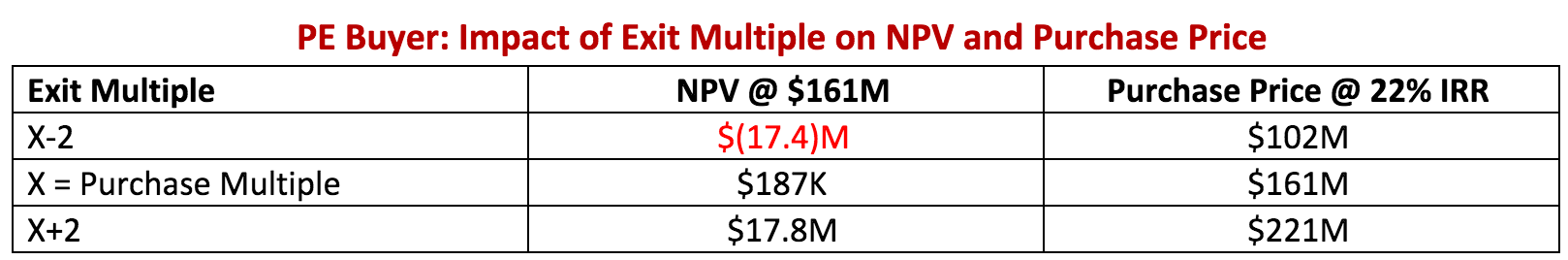

In our PE analysis of FantasyChem, we assumed that we could enter and exit at the same EBITDA multiple. In today’s seller’s market, this is more and more frequent compared to maybe 5 or 10 years ago when EBITDA multiple improvement was a key element of PE value creation. It may still be possible for a buyer to see an increase in multiple at exit as a result of improvements made to the business while under PE ownership, but a more conservative treatment is to eliminate this upside from initial consideration.

Hopefully this quick and simplified look at some key value drivers and the sensitivity analysis has shed some light on the motivations behind buyer behavior and priorities. In the final installment, we will take a look at the implications of some these results and offer some suggestions for buyers and sellers seeking to make the right deal in today’s business environment.