by Gary Shawhan and Dave Sikora Ph.D., The CHEMARK Consulting Group

The road to achieving net-zero CO2 emissions, as benchmarked for 2050 by the Paris Climate Agreement, looks much more like a drive down Lombard Street in San Francisco than the straight-a-way at Daytona International. Up until the last several years, a missing ingredient was actual commitment from the global chemical corporations forward through the value chain to actual change. Today, there is no question that rhetoric and philosophy have been replaced with definitive action.

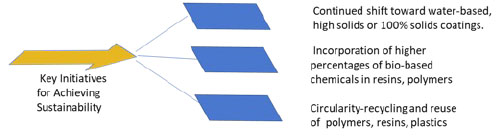

Sustainability represents the umbrella under which companies are challenged with taking meaningful actions that “move the needle” toward reducing carbon footprint, impacting climate change, and addressing waste recycling. In the chemical industry and for coatings manufacturers and their raw material suppliers, the drive towards sustainability is linked with several key issues as shown in Figure 1.

In particular, the replacement or partial substitution of petroleum-based products with renewable sources (primarily polymer/resins) is a high-profile target going forward. Alternative chemistries, which can produce bio-based chemicals, target the lowering of a company’s overall carbon footprint represent key renewable sources.

Figure 1: Key Contributors to Improved Sustainability

Sustainability is defined in somewhat different terms by a variety of sources. A couple of examples are as follows:

- Websters Dictionary- involving methods that do not completely use up or destroy natural resources

- International Institute of Sustainable Development- Sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs.

- EPA- Sustainability is based on a simple principle: Everything that we need for our survival and well-being depends, either directly or indirectly, on our natural environment. To pursue sustainability is to create and maintain the conditions under which humans and nature can exist in productive harmony to support present and future generations.

For more than 20 years sustainability initiatives in the coatings market, have focused on a reduction in carbon footprint through the greater use of water-based and high solids formulations. Government agencies have clearly played a key role in this effort by establishing a regulatory road map for industry compliance. These actions have driven end-users to increase their use of more environmentally friendly or “green” coatings.

While this effort continues, the lack of global uniformity in setting regulatory standards and then requiring compliance to them has been apparent. In addition, the performance limitations associated with water-based and high/100% solids coatings restricts their use in certain markets and applications.

It is probably fair to say that up until the last 5 years or so, sustainability efforts targeting a reduction in carbon footprint, beyond what was occurring with water-based formulations and a reduction in VOC’s, were more words than action.

Academic and industry dialogue, corporate proclamations, government warnings directed at the environment, climate change, and recyclability have not yet resulted in the level of effort required to achieve a net-zero carbon emission goal by 2050.

Today, however, you don’t have to look very far to recognize the changes which that have taken place in the chemical industry. Led by many major corporations in the chemical industry and including the major global coatings manufacturers, definitive sustainability initiatives are being implemented with the goal of meeting the net-zero target. OEM’s are now proactive in this effort and setting their own standards and challenging their suppliers to comply with their timeline.

Target dates are being announced for partial and eventual 100% compliance with the Paris accords. Manufacturing companies are setting target dates for coatings manufacturers to provide new products that deliver a certain percentage level of bio-based content in the formulation. Full scale manufacturing facilities are now being planned or have already been commercialized such as NatureWorks’ polylactic acid plant in Nebraska, US and Genomatica’s 1,4-butanediol plant in Italy. Other facilities have been announced by companies that will provide circularity for the resin/polymers and plastic materials they produce.

Table 1: Examples of Industry Sustainability Commitments and Initiative

- BASF has committed to achieving net zero carbon emissions by 2050 and 25% by 2030. Volvo’s net-zero target is 2040

- Dow Chemical- Initial availability of fully circular polymers to customers by 2022. Dow is helping customers develop more sustainable products including 100% recyclable solutions including the adding recycled or bio-based content into their products.

- OEM’s such as IKEA have now established targets for their suppliers to incorporate bio-based content in the range of 30-45% by certain dates

What is the difference? Why the change?

One answer is the heightened awareness and concern by consumers over the serious impact that climate change is having on day-to-day life and their concern for the future. It is no longer an abstract “down-the-road” concept without evidence to support it.

For the major coating manufacturers and multi-national chemical corporations, changes in their customer needs and buying habits are always a primary concern. In the case of sustainability, global companies (at multiple levels of the value chain) who serve markets which involve consumer choice and preference, understand they need to become an advocate. These companies are now at the forefront of leading the sustainability charge. Proclamations have transitioned to definitive commitments and actions. Companies are jumping on the sustainability “band-wagon”. Market leaders want to protect and enhance their position. Market challengers are focused on transitioning themselves to becoming a market leader.

Bio-based raw materials- assessing the challenges

Bio-based raw materials have moved to the top of the list of challenges for chemical companies and coating manufacturers as a necessary target to their overall sustainability efforts. Resins, polymers, and plastics are the primary focus based on the volume consumption of these materials. The impact created by a partial replacement of petrochemical derived chemicals with bio-based chemicals in reducing the overall carbon footprint in resins/polymers and for plastics is significant. Table 2 list key questions that will need to be answered by companies engaged in the effort to incorporate more bio-based chemicals into their products.

Table 2: Key Questions to Consider in the Use of Bio-based Raw Materials

- What alternative bio-based chemicals options exist today?

- Who manufactures these products, in what quantities, and where are they located?

- What level of performance can be achieved at what replacement percentage?

- What is the cost for these alternative chemistries? Will the market accept a “much” higher price?

What alternative bio-based chemical families exist today?

Renewable resources as raw materials, in place of petroleum derived raw materials, means plant biomass. The principle chemical families that comprise the renewable bio-based alternatives include the following:

Table 3: Alternative Bio-based Chemical Families

(1) Carbohydrates such as starches, sugar, cellulose, and hemicellulose

(2) Plant oils, specifically triglycerides (commonly soya oil) and the hydrolysis/methanolysis products of triglycerides. These chemistries include fatty acids/methyl esters-particularly those containing carbon-carbon double bonds, the so-called unsaturated ones- oleic, linoleic, linolenic, along with the triol, glycerol (glycerin).

(3) Lignins

(4) Proteins

*Note: In general, bio-based chemicals originating from the last two items represent a much smaller portion of the above four options in comparison to the first two categories.

Bio-based chemical raw materials that are principally being developed in the field of industrial polymers include: Thermoplastics; thermosets; and elastomers. They primarily serve as monomers, but in certain cases they are also used as curatives, crosslinking agents, and chain extenders.

Manipulation of carbohydrates via biotechnology employing microorganisms (fermentation) coupled with traditional organic process chemistry results in the formation of carboxylic acids R-C=O(OH), dicarboxylic acids (HO)0=C-R-C=O (OH), and diols. Such acids include, for example, acrylic acid, lactic acid, furan dicarboxylic acid, the C4 diacid succinic, and the C6 diacid adipic. The diols include 1,3-propanediol (1,3-PDO), 1,4-butanediol (BDO), 1,5-pentanediol (PDO), 1,6-hexanediol (HDO), and isosorbide. Nitrogen containing bio-based chemicals are rare compared to their oxygenated counterparts, however, worthy of mentioning is 1,5-pentamethylene diamine.

There are very few commercial products that are 100% derived from purely bio-based polymers. Most are hybrids of petrochemical-based and bio-based molecules.

Organic molecules containing carboxylic functionality and hydroxyl functionality are the key precursors to esters. Thus, many bio-based chemicals serve as monomers for aromatic, and aliphatic polyesters, and polymers containing polyester moieties such as the “soft” segment of polyurethanes. Bio-diols are also reactants for the synthesis of reactive vinyl monomers such as diol diacrylates and bis epoxides known as di-glycidyl ethers.

Within the chemical industry the current petrochemical derived-materials are targets for hybridization with bio-based chemicals are recognized. Significant steps are being made by chemical companies to facilitate the production of such hybrids intended to address the growing demand for greater bio-based content products.

Table 3: Key Takeaways on Bio-based Resins/Polymers

- Tremendous progress has been made in development and commercialization of bio-based chemistries via the marriage of industrial biotechnology and traditional chemical processing

- Carbohydrates have served as a prominent biomass raw material

- Prolific use of bio-based chemicals already exists in the polymer industry, particularly as monomers

- Hybrid (petro-bio) polymers dominate the field (relative to pure bio-based chemicals) for industrially used bio-based polymers. 100% bio-based polymers are not required to make an impact on sustainable products and carbon footprint reduction

- Some bio-based chemicals provide an opportunity for delivering new performance properties in the polymer that were previously unrecognized or unachievable with purely petrochemically- derived raw materials

- New industrial biotechnology companies and new divisions of major chemical companies continue to spawn ensuring continual innovation, development, and commercialization of bio-based chemicals and their downstream products

Part 2 of this article will focus on the chemical options for different resin/polymer categories. These include polyurethanes, polyamides, aromatic polyester polymers, aliphatic polyester polymers, acrylic acid and derivatives, and epoxies and derivatives. The cost impact of higher bio-content resins/polymers will also be discussed along with view on the availability of these chemicals going forward.