By Gary Shawhan, Phil Phillips Contributing Editors, The CHEMARK Consulting Group

A logical place to start a discussion on value chain is a reference to Porter’s definition of value chain analysis and its purpose.

“Value chain analysis focuses on analyzing the internal activities of a business in an effort to understand costs, locate the activities that add the most value, and differentiate you from the competition”.

In the context of this definition, the value chain is a tool to be used to identify where efficiency and profitability can be improved at all levels of the organization. For an internally directed value chain analysis to be successful, management needs to insure there are no “sacred cow’s”. The process should be organized and communicated as being free of concern from retribution among all the participants. The goal is to make this a team effort with the goal of strengthening the company’s competitive position within the markets they participate and with the customers they serve.

Alternatively, a value chain analysis is used to identify the individual costs that exist through the supply chain which impact price and profitability of the company’s products or services. The goal, in this case, is to identify the constraints as well as the opportunities that may exist within a given market space for maximizing profitability.

In this article we will focus on the values associated with doing value chain analysis involving the costs that come from the elements of the supply chain (Figure: 1).

Figure 1: Basic Alternative Uses of Value

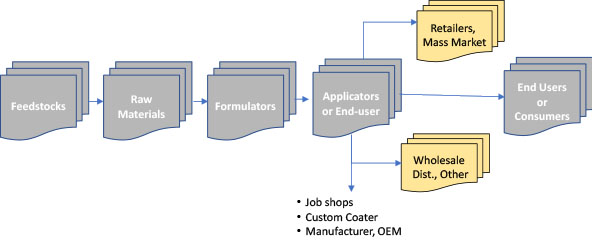

his article focuses on the benefits associated with using value chain analysis to understand the elements of cost. Figure 2 identifies representative elements of the supply chain that are common to coatings manufacturing and important to address when doing a value chain analysis.

Figure 2: Representative Value Chain Elements for Coatings

Their importance, within each of these elements, will vary significantly depending on the market(s), the technology and even the geographies that are being analyzed. For example, feedstock availability and vacillations in feedstock prices can play a major role in assessing price points, pricing policies and profitability expectations.

Raw material costs, both additives and resins, along with the actual costs to convert these raw materials to a finished product and then package it all need to be considered. They are key to setting a price point that provides the desired level of profitability or determining what price points are obtainable within a given market space.

From the position of the formulator, all these costs are ones that they can monitor, track. They are also ones that can be impacted through choice, operational efficiency, and management practice. A value chain can help identify and quantify them.

Forward from the formulator, value chain analysis in intended to reveal both the opportunities and/or the constraints that exist within a given market space for value-added pricing.

Market dynamics has a significant influence on the ability of suppliers to capture value (products or services). Having a strong value proposition for a given product (or services) is important. When these products provide clear differentiation from competitors, maximizing profits through setting the right price point at the outset of market introduction represents an opportunity. Again, an understanding of the market through a value chain analysis can be very helpful in this regard.

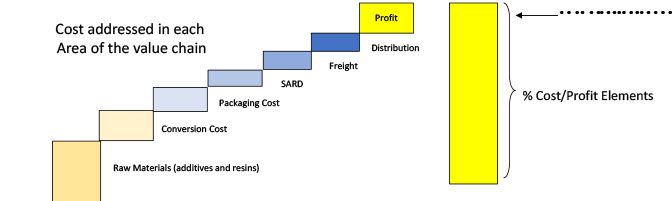

Figure 3 shows the various components of cost that are commonly considered in a value chain analysis. Depending on the portion of the value chain being analyzed, not all these components of cost may apply or be relevant.

Figure 3: Costs assessed in Value Chain Analysis for by Element

Management’s reasons and expectations for developing a value chain vary. The scope and bounds within which this effort is defined is always unique to the company, its product or services and its business situation. The fundamental objective for doing a value chain analysis is to understand all the elements of cost that impact profitability.

The methodologies for doing the analysis need to be well defined at the outset to ensure that the focus for these investigations supports managements goals for doing it and potential decision making that may follow.

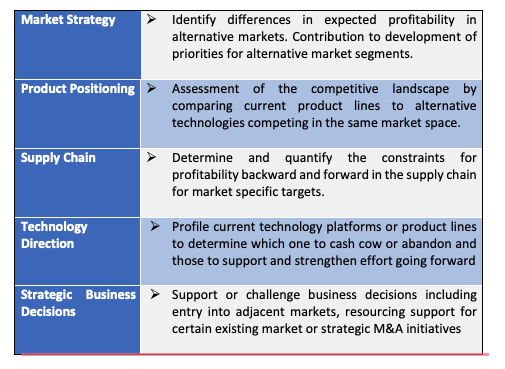

Some typical reasons for doing a value chain analysis are listed in Table 1.

Table 1: Why do a value chain analysis? Some Examples

Identifying Opportunities or Constraints on Profitability

A value chain analysis can reveal where opportunities exist for achieving or increasing profits. Conversely, value chain analysis is intended to identify constraints that exist for increasing prices for products you sell into alternative markets.

When the value chain is highly constrained there is little or no room to increased prices. Existing customers have limited ability to pass along any increases in prices without a risk of losing business at their customers.

Value chain analysis allows management to compare alternative market segments for their products and identify the space that exists for profit capture. Market segments, for example, that require a high level of performance from coatings should have a favorable value chain profile. Doing this analysis can either support or challenge company strategies to support and invest in product development and resource deployment.

There are many reasons constraints exist in the value chain. Some more obvious that others. Packaging costs can be high. Distribution and the costs associated with using a distribution network, warehousing costs as may be required to support individual customer requirements (e.g., JIT) all limit the ability of the supplier to increase prices.

Markets that involve sales through retail channels, including sales through the larger retail chains, introduce major constraints in the value chain for coating formulators and the major additive and resin suppliers that support them. Profit margins, in these circumstances, are controlled at the retail level. Limited room exists for increasing prices as you move backward in the value chain.

Emerging markets or markets impacted by major transitional changes such as regulatory activity or environmentally driven legislation often provide opportunities for improved profitability.

Plotting a shift in strategic direction to take advantage of circumstances such as this also involves a decision to support the investments that are needed to purse them. Value chain analysis is a tool for looking more closely at the space that exists forward in the supply chain (in these situations) to set the desired price points.

In today’s coatings market the global drive for sustainability and the greater use of bio-based raw materials will challenge the tolerance of the value chain to accept higher prices in certain markets. The added costs for implementing this change will force suppliers to increase prices beyond what has traditionally been allowable in a variety of end-use markets.

The shift toward sustainable products will create opportunities for improving profit margins for some companies by offering new products. It will challenge others to retain their present market share if they are unable to address this shift in the technology preference. In either case, this challenge created for this transition will be felt in different ways throughout the various elements of the supply chain. Employing a value chain analysis in plotting business strategy is one of the tools management should consider.