Gary Shawhan, Phil Phillips, Contributing Editors

The CHEMARK Consulting Group

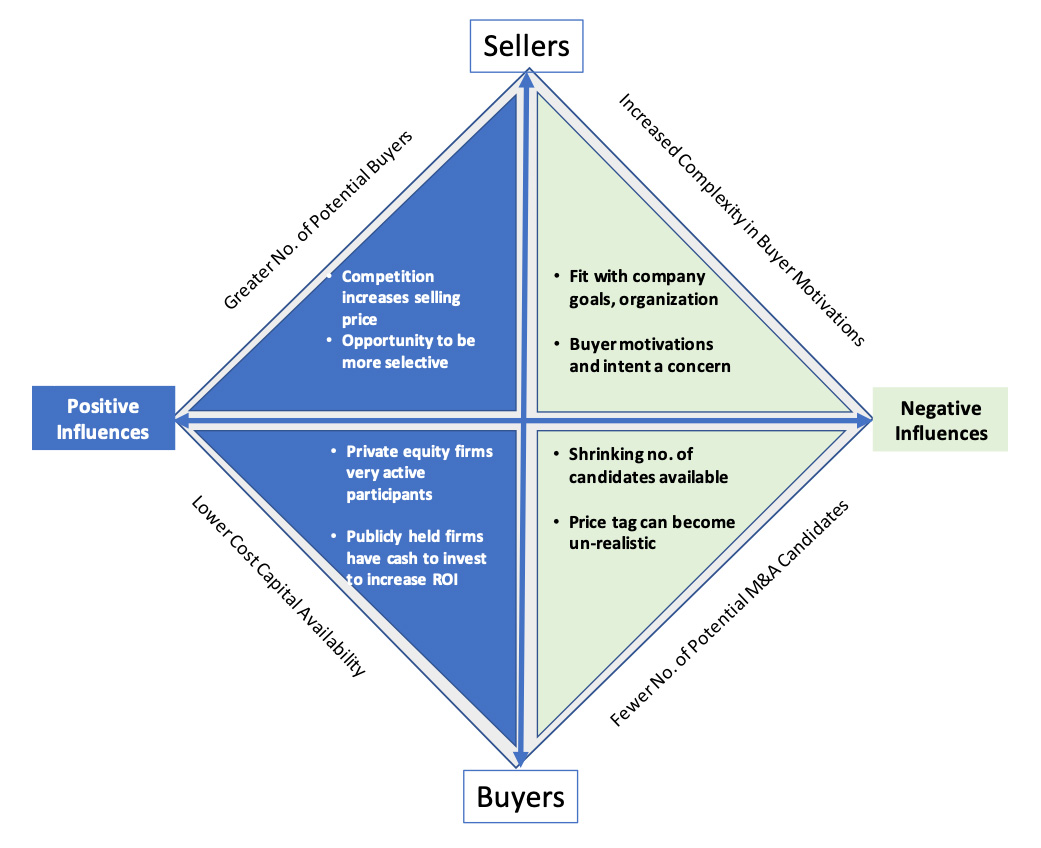

Buyer categories include private equity firms, publicly traded organizations and entrepreneurs/independent investors. In all these cases, the availability of low-cost capital or cash provides the engine for a very active M&A market climate.

Today, the number of potential candidate companies has shrunk and continues to get smaller especially in the mid-sized company range. . In addition, competition among buyers for these remaining candidate companies has push-up the price tag to a level that sometimes creates a marginal or unrealistic return on invested capital (ROI).

Private equity firms are typically focused on identifying companies that have a niche’, well defined market position or novel technology that will benefit from an infusion of capital. This may be through the addition of resources or other capital investments that jump-start of stimulate revenue growth. As a general rule private equity firms want to enter businesses that are positioned (within their product life cycle) either as embryonic or considered as operating in the growth side of the life cycle curve. Ultimately, the objective of private equity firms is to reap the value of their investments in the business by exiting it at a future date.

As buyers, corporations, privately owned businesses or entrepreneurs/independent investors most often target acquiring companies that compliment and/or expand their business position. M&A intent varies but includes one or more of these business objectives: (a) Increase of market share or geographic market reach; (b)addition of complimentary products that strengthen the current market position; (c) grow revenues and improve cash flow from current operations making the company more competitive; (d) expand or improve channel-to-market positioning.

Figure 2: Contrasting Value Drives

Overall, the M&A drivers vary (and often significantly) between private equity firms and in-market buyers whether corporations, privately owned businesses or entrepreneurs. With the large number of perspective buyers participating today, seller preparation and planning becomes extremely important. This is not only to maximize their return on the sales of the business. It is also because of possible negative impacts that might occur during the process of selling the business. Preparation and planning are also important in order to anticipate and address unwanted consequences that may result from its sale. This is especially true for medium to smaller sized companies that are privately owned.

Table 1: Seller Considerations

- Manage Information Flow//Maintain Confidentiality

During the M&A process managing information flow and follow-up is key. Most important, detailed information regarding the business, including financial details, need to be exchanged. Protection of this information is critical to the future success of the company. - Identifying buyer priorities, needs and addressing their concerns

The methodologies used during the M&A process to achieve a successful result are founded on providing a forum within which buyers can communicate their priorities and the specific needs that can be achieved through acquisition of the company. Just as important is the identification of key concerns and the efforts put forth to address and resolve these issues. - Clearly define personal and business priorities and articulate the desired outcomes

Each owner or public company has specific business priorities and desired outcome goals for the sales of the business. For privately owned company’s personal goals and outcomes are especially important. This includes concerns for the existing employees who often are long-time company contributors. It is also tied to the reputation and brand identities that has been established over an extended period of time. How these issues are dealt with during the M&A process, is important in cultivating the best candidate buyers. It is also important in avoiding misunderstandings that might arise later in the process.

In dealing with the above issues, intermediaries (advisors/consultants) in the M&A process have a definite value. Intermediary companies provide a buffer between the buyer and seller. Keeping the process outside of the company also insulates employees from these activities avoiding unwanted internal repercussions. Employing an intermediate also facilities dialogue from both sides that assists in addressing specific concerns or business issues that can be resolved through understanding and/or compromise.